KPI’s to Improve your Construction Fleet Profitability

Using Fleet Management KPI’s to Improve Construction Equipment Maintenance Operations

Industry-wide effort establishes standards and benchmarks for heavy civil contractors. Recent publication and promotion of the Heavy Equipment Comparator by the Association of Equipment Management Professionals (AEMP) and Construction Financial Management Association (CFMA) has cast new light on an important way to improve heavy equipment maintenance.

Equipment essential in heavy civil work is expensive to own, operate and maintain. Still, many contractors struggle to measure their costs and the performance of their maintenance operations and to compare that performance against that of similar companies. A task force of AEMP and CFMA members was formed in 2022 to help them do both.

Step one was to identify metrics most critical to fleet and maintenance performance. The group eventually narrowed the list to 32 metrics. Half are related to financial costs, utilization and safety. A second category covers maintenance processes including preventive work, scheduling, and mechanic efficiency.

Next, the group defined the 32 metrics and how contractors should measure them, an important step toward standardization. Finally, a survey was conducted among contractors to establish initial industry benchmarks.

These are my five examples of metrics that are covered by the Comparator and common among fleet maintenance operations:

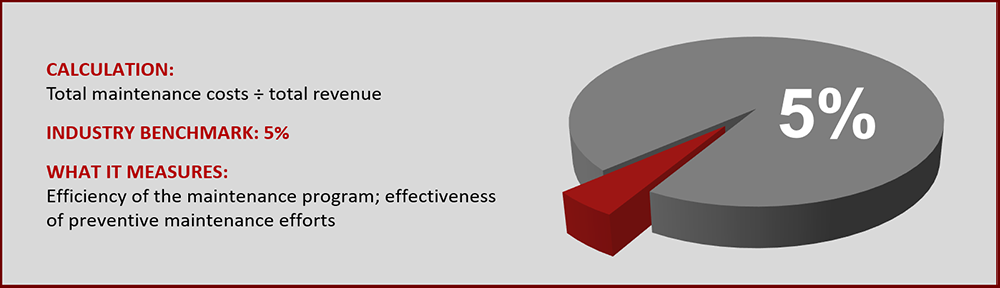

Equipment Repair and Maintenance Costs as a Percentage of Revenue

Dividing total maintenance costs by a contractor’s overall revenue from construction contracts is a good way to determine the effectiveness of the maintenance operation. Metrics indicate both how the company is performing relative to its competitors and whether improvements are being made over time.

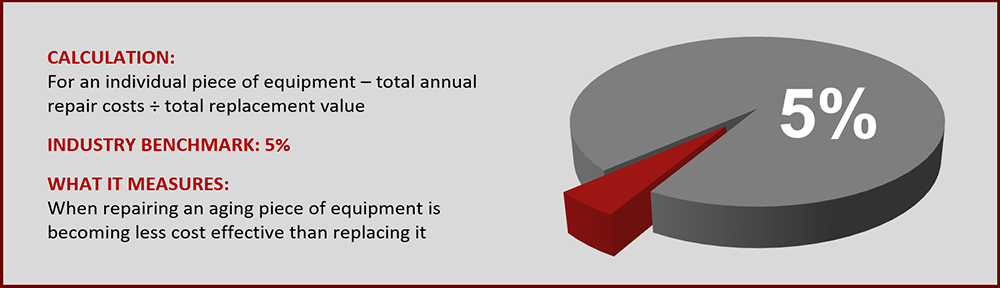

Equipment Repair and Maintenance Costs as a Percentage of Estimated Replacement Value

This metric helps contractors find the point in time when replacing an individual asset becomes more cost effective than continuing to maintain and repair it. The formula is not absolute. Cash flow, anticipated work volume and other factors should be considered, but this provides a good warning sign to evaluate further.

Percentage of Preventive Maintenance Hours

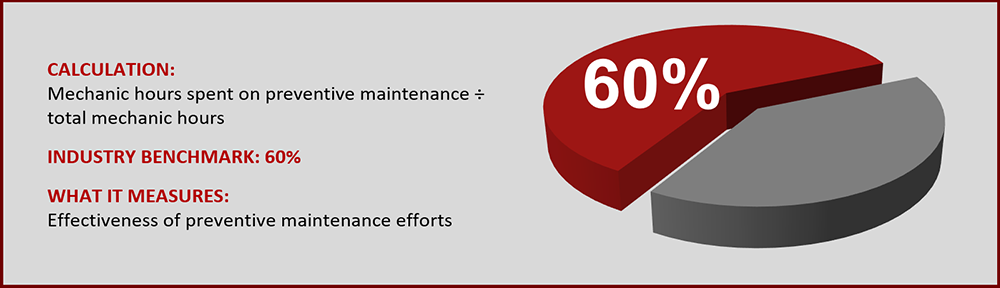

Doing preventive maintenance as recommended and at the prescribed times cuts overall maintenance costs and reduces unscheduled downtime. In a high performing maintenance operation, well over 50 percent of mechanic hours should be devoted to proactive, preventive work as opposed to responding to unexpected breakdowns.

“Wrench Time” as Percentages of Overall Mechanic Time

The amount of time valuable equipment mechanics spend actually performing fleet maintenance and repairs, as opposed to traveling or doing administrative work, is a good indicator of the efficiency and cost effectiveness of the maintenance operation.

Expanded interest in these and other equipment maintenance KPIs has focused attention on the importance of specialized equipment maintenance software. Applications like B2W Maintain make it easy for contractors to access the ingredient vital to their KPI tracking efforts: data. Without this type of specialized software, exhaustive manual efforts are often required to pull together information on maintenance activities and costs from accounting systems, spreadsheets, paper forms and other sources.

Computerized maintenance management software (CMMS) systems consolidate maintenance data and work cohesively with construction accounting systems, making it easy to produce comprehensive reporting for KPI tracking.

Herb Brownett’s Five KPI’s to Improve your Construction Fleet Profitability (Oct 2020)

Every golfer I know keeps score each round and can tell you several numbers about their game. These include best score ever, target score on home course and, if they are serious, their handicap. Why keep track? As a long-struggling golfer, I can tell you, it is to measure improvement and strive to be better. I recommend that construction managers and executives responsible for their fleet profitability take a similar approach, assisted by construction equipment maintenance software like B2W Maintain. Most businesses track key numbers. In construction, these include annual revenue, gross profit margin and backlog. Refining this with additional metrics tailored to the business called key performance indicators (KPI’s) has become vogue. The intent is to create and track KPI’s that reflect significant aspects of the business, so management can improve them. Think of this as a handicap for each key business activity.I have been surprised in my consulting, and other industry activities, to learn how few heavy construction contractors track KPI’s related to their equipment fleets. I have written in previous white papers about how significantly a company’s bottom line can be influenced up or down by the quality of its fleet management program.There are many KPI’s for fleet management, but these are my five favorites. They are common, and collectively cover most of the profit related issues of fleet management. For each one, I will identify the KPI, show how it is calculated, tell you the industry benchmark for good performance and explain what it measures and why that is important for improving construction fleet profitability.

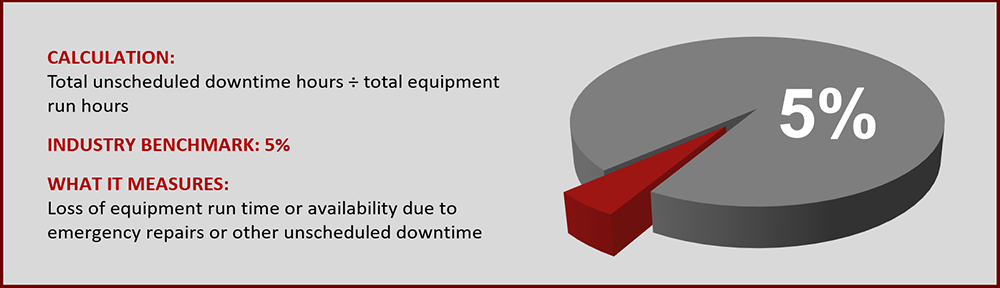

1. Unscheduled Downtime

The single greatest equipment related profit leak, in my opinion, is unscheduled downtime. When a piece of equipment is on a job site and is needed, but cannot be operated, it creates three unnecessary costs.

- The loss of recovery of ownership costs.

- The potential rental costs of a substitute piece of equipment.

- Most importantly, is the disruptions of the job schedule and workflow.

The industry average for unscheduled downtime hours is approximately 25%. Best-in-class companies drive this to under 5%. The key factor is a rigorous and disciplined program of preventative maintenance.

2. Percentage of Preventive Maintenance Hours

As noted above, preventative maintenance is the key to reducing unscheduled downtime. This metric measures whether mechanics are spending time on the appropriate amount of preventative maintenance versus emergency repairs. In other words, they spend more time preventing fires than fighting fires.

3. Maintenance Costs as a Percentage of Estimated Replacement Value

The cost to maintain and repair aging equipment, at some point starts to jump by increasingly large amounts each year. This metric for an individual piece of equipment is a good tripwire to indicate that it’s time to evaluate further whether it’s time to dispose of the asset.

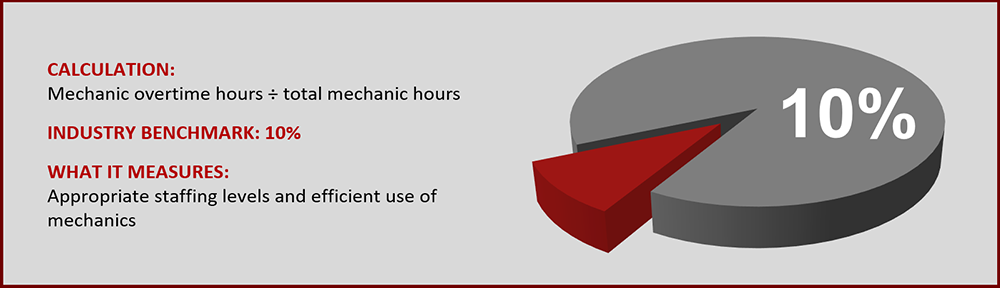

4. Percentage of Maintenance Overtime Hours

Heavy equipment mechanics are valuable assets. Excessive overtime wears them down, decreases productivity and may indicate that you do not have enough mechanics. Efficient use of mechanics can be improved by automating scheduling and their work orders.

5. Maintenance Cost as a Percentage of Revenue

Total maintenance costs are a significant part of company costs. The total is influenced by many things, including some of the previously discussed items. At a high level, it is important for management to know if total maintenance costs are inline with a company’s work volume and revenue.

Best-in-class heavy construction companies track these KPI’s, and others, to constantly improve. B2W Maintain provides tools to facilitate this. While you are out improving your golf game, think about improving your construction fleet profitability.